Treasury$12,000,000$12,000,000

Commonwealth Bank of Australia

Transaction Account

Bank of New York

Term Deposit

Citi Bank

Interest

NAB

Expenses

€7,1257,125

EUR

$8,2658,265

USD

Automate global finances from one platform

Transform scattered bank accounts into a unified financial command center. Optimize cash across your business’s currencies and institutions.

Built on top of leading financial institutions

Automate global finances from one platform

Transform scattered bank accounts into a unified financial command center. Optimize cash across your business’s currencies and institutions.

Treasury$12,000,000$12,000,000

Commonwealth Bank of Australia

Transaction Account

Bank of New York

Term Deposit

Citi Bank

Interest

NAB

Expenses

€7,1257,125

EUR

$8,2658,265

USD

Built on top of leading financial institutions

Trusted by finance teams that move billions.

From startups to large enterprises, Primary's help teams save time and grow money.

E-Commerce

Growth

Space

Enterprise

Natural Resources

Enterprise

Health

Growth

Healthcare

Growth

Energy

Growth

Financial Services

Growth

Software

Enterprise

Creative

Growth

Legal

Growth

E-Commerce

Growth

Search

Growth

B2B Fintech

Enterprise

Consumer Goods

Growth

Sports

Enterprise

Keep your existing banks. Actually, keep everything.

Unlike other fintechs, Primary sits as a layer on top of the banks and systems you already trust.

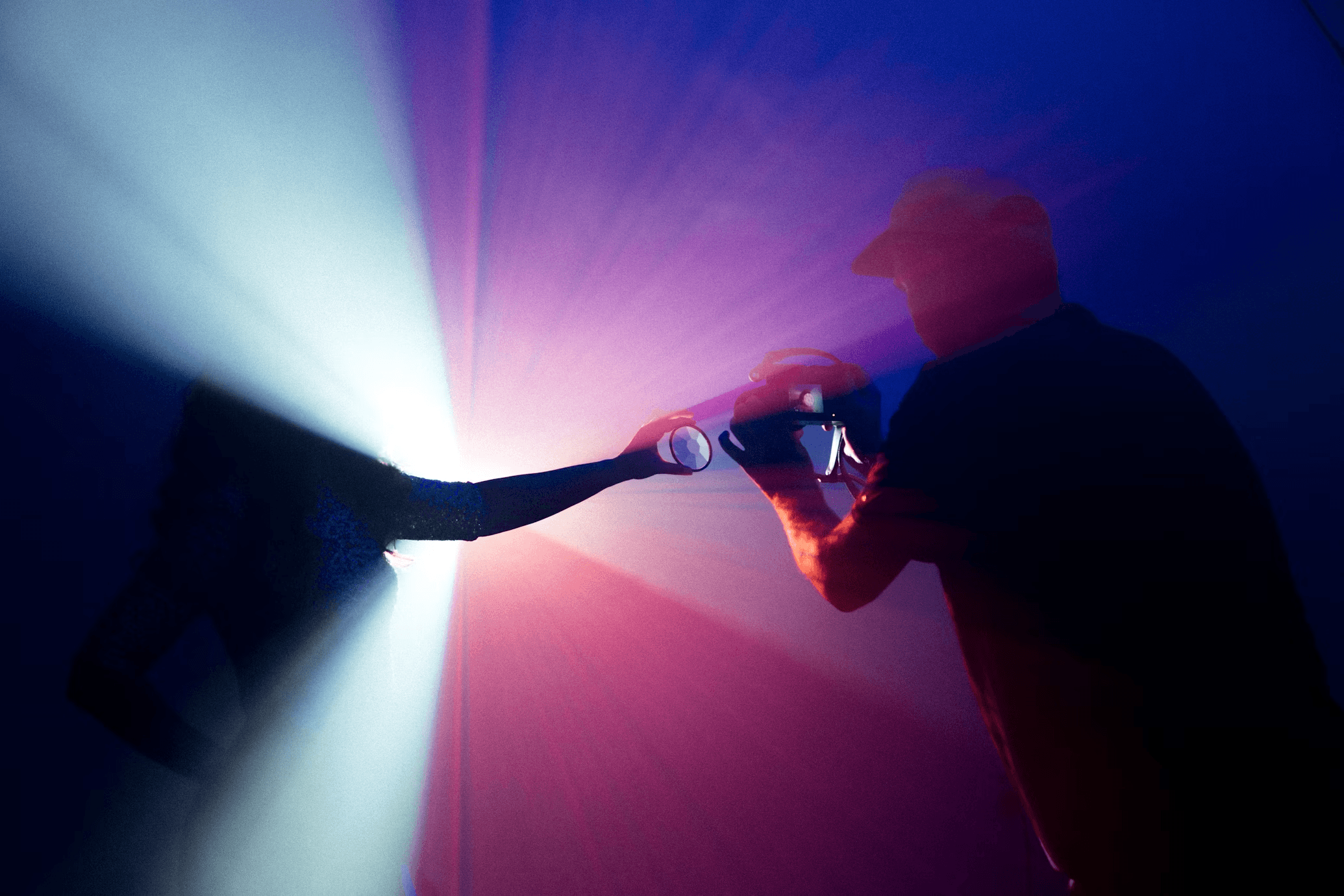

Primary sits as a layer on top

Banks

Payment Processors

Accounting Systems

Internal Systems

Primary Accounts

No migration risk or disruptions

Keep your existing operations intact. No switching or overhauling what you have.

Keep your banker happy

Those banking relationships you spent years building? They stay exactly as they are.

Implementation in days

Just 7 days is all the average business needs to see benefits. The fastest ROI you'll ever see.

Smarter automation at every step.

Surface the cash opportunities you're missing while automating the reconciliations you're tired of doing. Developed methodically, implemented carefully, because your treasury isn't a testing ground.

Strategic analysis based on your actual numbers.

Drop in your cashflow projections, budget forecasts, or FX exposure models. Our intelligence analyzes your scenarios and returns actionable insights tailored to your specific situation.

The foundation of modern treasury management.

Manage FX exposure, optimize yield across currencies, control all your accounts, and automate sweeping. The core financial operations that run your business, unified and automated.

Automated sweeping that maximizes every idle dollar.

Your excess cash finds better returns automatically. Operating accounts stay funded. Everything in balance, no dollar left idle.

Rules

- Forall available funds

- Keep$500,000maximumin operation

FX volatility doesn't have to hurt.

Track exposure limits, quantify risk in dollars, and execute hedges before the next swing costs you.

Overviews

- AUD852,316.11

- USD914,645.35

- GBP2,251.35

- SG9,241.78

- JP1,985.23

Institutional rates your bank can't match.

While others settle for near 0% bank rates, Primary gives you exclusive access to institutional yield products that traditional banks reserve for their largest clients.

Balance$12,612,369

With Primary

Average Yield4.6%

You earn$4,600p.a

- Macquarie Bank4.4% yield

- State Street5.6% yield

- Morgan Stanley4.1% yield

- Goldman Sachs5.7% yield

- BlackRock5.7% yield

Every account. Every currency. One view.

No more poor cash visibility. Stop juggling 10 bank logins and outdated spreadsheets - integrate every account into one place.

Accounts

Security as uncompromising as your standards.

Primary maintains institutional-grade security while ensuring complete transparency and control over your financial operations.

Bank-Level Security

Your data protected with the same standards used by leading financial institutions.

Multi-factor Authentication

Enterprise-grade access control.

Funds held directly with tier-1 institutions

Funds custody with the world's most trusted institutions.

SSO

Seamless single sign-on integration with your existing enterprise systems.

Encryption at rest

Bank-grade encryption protects your data when stored and in transit.

Proactive security testing and monitoring

Continuous threat detection and regular penetration testing ensure ongoing protection.

As an SEC-registered investment advisor in the US and a corporate authorised representative under AFSL in Australia, Primary operates under strict regulatory oversight to protect your business.

Built for how your business and teams actually work.

From your existing tech stack to automated reporting to worldwide coverage, Primary scales alongside you and your ambitions.

Don't change your tools for us. We integrate with yours.

From major global banks to Xero to Stripe, your entire finance stack stays intact while we orchestrate seamlessly.

From blind spots to total visibility.

No more logging into multiple banks or updating spreadsheets. See consolidated balances, burn rates, and runway across all entities and currencies in real-time.

(Try click one)Financial Performance

Built for global businesses.

Primary serves 25+ countries across North America, Europe, and Asia-Pacific. Move USD to EUR to SGD seamlessly with full compliance across all subsidiaries.

From founders to Fortune 500, we solve what matters.

Stop losing money on currency swings

Monitor exposure in real-time. Execute at institutional rates when it matters most.

See all your global cash in one place

Connect all your banks, subsidiaries, and currencies to get a real-time picture of your complete cash position.

Make your fundraise last longer

4.5% institutional yields extend runway by 2.5 months on average.

Works with everything you already have

Orchestrates your current banks and tools into one intelligent system.

Earn money on temporary funds

Automated sweeping turns idle payment float into yield opportunities.

Set it and forget it with intelligent policies

Define your strategy once, and have Primary automatically execute 24/7 without manual intervention.

Earn an additional

(Compared to only $12,500 at traditional banks)

$3M balance

- Runway Extension8 days

- Monthly Cash Flow Increase+$8,333

Move every dollar to exactly where it should be.

Sleep knowing your cash works as hard as you do, around the clock.